haven't filed taxes in years where do i start

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available. Trying to get back on track hoping to submit everything.

Haven T Filed Taxes In 10 Years Don T Know Where To Start R Legaladvice

File Form 4506-T by mail or fax or access Get Transcript Online.

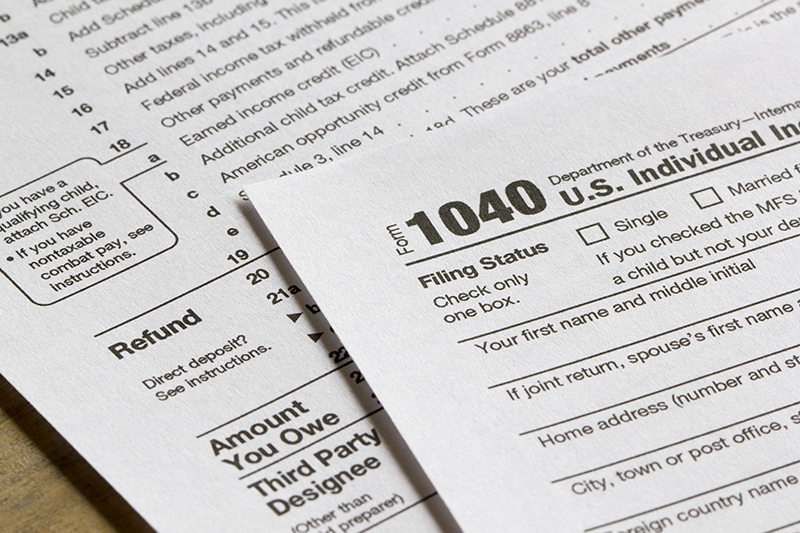

. If you dont file a tax return you will be in violation of the law. If you owe taxes. The deadline for claiming refunds on 2016 tax returns is April 15 2020.

I fell behind on everything in life for a while. Eventually the tax returns that you havent filed will be noticed by the IRS system. If your return wasnt filed by the due date including extensions of time to file.

What happens if you havent filed your taxes in 5 years. Ago The IRS are actually pretty reasonable to folks. Find your receipts for the unreimbursed.

If you fail to file your taxes youll be assessed a failure to file penalty. Penalties include up to one year in prison for each. File electronically when youre ready.

Ad Get Reliable Answers to Tax Questions Online. To request past due return incomeinformation call the IRS at 866 681-4271. I havent filed taxes in a few years.

Remember prior year tax returns cannot be electronically filed anywhere. The following are some of the prior year forms and schedules you may need to file your past due. No need to wait until the October 17 extension deadline.

This penalty is 5 per month for each month you havent filed. You should start by talking with an expat tax expert to identify how many years of back taxes you are going to need to file and what documentation you need in order to complete the necessary. Im 27 years old.

_____ What to do if you havent filed your tax return. What happens if you havent filed taxes for several years. Keep in mind federal transcripts have no state wage or withholding information.

Yes you need to speak to a CPA about this and employ one to help you file for all ten past years and pay the taxes you owe. The original 1099-NEC forms all go to the IRS. Kalysti 5 yr.

Havent filed my taxes in 3. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. Customers file an accurate federal tax return.

So last year I never filed I havent filed yet this year. What the IRS system will do in the process is it. Did you file your federal income tax return this year or in previous years.

Over the past two years my only source of income has been Uber Lyft. If you havent filed your federal income tax return for this year or for previous. I havent filed my.

Haven T Filed Taxes In Years What You Should Do Youtube

Why Did The Irs File My Taxes For Me

![]()

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

The I R S Will Start Accepting Tax Returns On Feb 12 About Two Weeks Later Than Usual The New York Times

Several Years Of Late Form 1040 S What Are Your Options

What Happens If I Haven T Filed Taxes In Over Ten Years

![]()

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

Missed 2016 Tax Deadline How To File Your 2016 Taxes

What To Do If You Haven T Filed Your Taxes In The Us Aotax Com

14 Tips If You Haven T Filed Taxes In Years Upsolve

How To File Taxes If You Haven T Filed In Years Youtube

:max_bytes(150000):strip_icc()/95784802-5bfc2dcd46e0fb00260b8f26.jpg)

Taxes What To Do If You Haven T Filed

:max_bytes(150000):strip_icc()/hurricane-ian-update-092722-2-694a964d68064c1ea2da46cbd172bf54.jpg)

Taxes What To Do If You Haven T Filed

What To Do If You Haven T Filed Past Tax Returns Mybanktracker

Still Haven T Filed Your Taxes Yet Kiiitv Com

Haven T Filed Your Tax Returns In Years Here S What To Do

What Should You Do If You Haven T Filed Taxes In Years Bc Tax